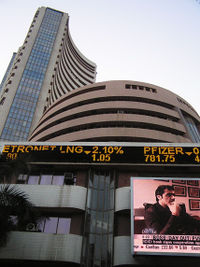

Bombay Stock Exchange

| Bombay Stock Exchange | |

|---|---|

|

Mumbaī Śhear Bājār

|

|

|

|

|

|

| Type | Stock Exchange |

| Location | Mumbai, India |

| Founded | 1875 |

| Owner | Bombay Stock Exchange Limited |

| Key people | Madhu Kannan (CEO & MD) |

| Currency | |

| No. of listings | 6.123 |

| MarketCap | US$1.28 trillion (Feb, 2010) |

| Volume | US$980 billion (2006) |

| Indexes | BSE Sensex |

| Website | www.bseindia.com |

The Bombay Stock Exchange (BSE) (Marathi: मुंबई शेअर बाजार Mumbaī Śhear Bājār) (formerly, The Stock Exchange, Mumbai) is the oldest stock exchange in Asia and largest number of listed companies in the world, with 4900 listed as of Feb 2010.[1][2] It is located at Dalal Street, Mumbai, India. On Feb, 2010, the equity market capitalization of the companies listed on the BSE was US$1.28 trillion, making it the 4th largest stock exchange in Asia and the 11th largest in the world.[3]

With over 4900 Indian companies listed & over 7700 scrips on the stock exchange,[4] it has a significant trading volume. The BSE SENSEX (SENSitive indEX), also called the "BSE 30", is a widely used market index in India and Asia. Though many other exchanges exist, BSE and the National Stock Exchange of India account for most of the trading in shares in India.

Contents |

Hours of operation

| Session | Timing |

|---|---|

| Beginning of the Day Session | 8:00 - 9:00 |

| Trading Session | 9:00 - 15:30 |

| Position Transfer Session | 15:30 - 15:50 |

| Closing Session | 15:50 - 16:05 |

| Option Exercise Session | 16:05 - 16:35 |

| Margin Session | 16:35 - 16:50 |

| Query Session | 16:50 - 17:35 |

| End of Day Session | 17:30 |

The hours of operation for the BSE quoted above are stated in terms of the local time (i.e. GMT +5:30) in Mumbai (Bombay), India. BSE's normal trading sessions are on all days of the week except Saturdays, Sundays and holidays declared by the Exchange in advance.[5]

History

The Bombay Stock Exchange is the oldest exchange in Asia. It traces its history to the 1850s, when 4 Gujarati and 1 Parsi stockbroker would gather under banyan trees in front of Mumbai's Town Hall. The location of these meetings changed many times, as the number of brokers constantly increased. The group eventually moved to Dalal Street in 1874 and in 1875 became an official organization known as 'The Native Share & Stock Brokers Association'. In 1956, the BSE became the first stock exchange to be recognized by the Indian Government under the Securities Contracts Regulation Act. The Bombay Stock Exchange developed the BSE Sensex in 1986, giving the BSE a means to measure overall performance of the exchange. In 2000 the BSE used this index to open its derivatives market, trading Sensex futures contracts. The development of Sensex options along with equity derivatives followed in 2001 and 2002, expanding the BSE's trading platform. Historically an open outcry floor trading exchange, the Bombay Stock Exchange switched to an electronic trading system in 1995. It took the exchange only fifty days to make this transition. This automated, screen-based trading platform called BSE On-line trading (BOLT) currently has a capacity of 80 lakh orders per day. The BSE has also introduced the world's first centralized exchange-based internet trading system, BSEWEBx.co.in to enable investors anywhere in the world to trade on the BSE platform.

Timeline

Following is the timeline on the rise and rise of the Sensex through Indian stock market history.

1830's Business on corporate stocks and shares in Bank and Cotton presses started in Bombay.

1860-1865 Cotton price bubble as a result of the American Civil War

1870 - 90's Sharp increase in share prices of jute industries followed by a boom in tea stocks and coal

1978-79 Base year of Sensex, defined to be 100.

1986 Sensex first compiled[7] using a market Capitalization-Weighted methodology for 30 component stocks representing well-established companies across key sectors.

30 October 2006 The Sensex on October 30, 2006 crossed the magical figure of 13,000 and closed at 13,024.26 points, up 117.45 points or 0.9%. It took 135 days for the Sensex to move from 12,000 to 13,000 and 123 days to move from 12,500 to 13,000.

5 December 2006 The Sensex on December 5, 2006 crossed the 14,000-mark to touch 14,028 points. It took 36 days for the Sensex to move from 13,000 to the 14,000 mark.

6 July 2007 The Sensex on July 6, 2007 crossed the magical figure of 15,000 to touch 15,005 points in afternoon trade. It took seven months for the Sensex to move from 14,000 to 15,000 points.

19 September 2007 The Sensex scaled yet another milestone during early morning trade on September 19, 2007. Within minutes after trading began, the Sensex crossed 16,000, rising by 450 points from the previous close. The 30-share Bombay Stock Exchange's sensitive index took 53 days to reach 16,000 from 15,000. Nifty also touched a new high at 4659, up 113 points.

The Sensex finally ended with a gain of 654 points at 16,323. The NSE Nifty gained 186 points to close at 4,732.

26 September 2007 The Sensex scaled yet another height during early morning trade on September 26, 2007. Within minutes after trading began, the Sensex crossed the 17,000-mark . Some profit taking towards the end, saw the index slip into red to 16,887 - down 187 points from the day's high. The Sensex ended with a gain of 22 points at 16,921.

9 October 2007 The BSE Sensex crossed the 18,000-mark on October 9, 2007. It took just 8 days to cross 18,000 points from the 17,000 mark. The index zoomed to a new all-time intra-day high of 18,327. It finally gained 789 points to close at an all-time high of 18,280. The market set several new records including the biggest single day gain of 789 points at close, as well as the largest intra-day gains of 993 points in absolute term backed by frenzied buying after the news of the UPA and Left meeting on October 22 put an end to the worries of an impending election.

15 October 2007 The Sensex crossed the 19,000-mark backed by revival of funds-based buying in blue chip stocks in metal, capital goods and refinery sectors. The index gained the last 1,000 points in just four trading days. The index touched a fresh all-time intra-day high of 19,096, and finally ended with a smart gain of 640 points at 19,059.The Nifty gained 242 points to close at 5,670.

29 October 2007 The Sensex crossed the 20,000 mark on the back of aggressive buying by funds ahead of the US Federal Reserve meeting. The index took only 10 trading days to gain 1,000 points after the index crossed the 19,000-mark on October 15. The major drivers of today's rally were index heavyweights Larsen and Toubro, Reliance Industries, ICICI Bank, HDFC Bank and SBI among others. The 30-share index spurted in the last five minutes of trade to fly-past the crucial level and scaled a new intra-day peak at 20,024.87 points before ending at its fresh closing high of 19,977.67, a gain of 734.50 points. The NSE Nifty rose to a record high 5,922.50 points before ending at 5,905.90, showing a hefty gain of 203.60 points.

8 January 2008 The sensex peaks. It crossed the 21,000 mark in intra-day trading after 49 trading sessions. This was backed by high market confidence of increased FII investment and strong corporate results for the third quarter. However, it later fell back due to profit booking.

13 June 2008 The sensex closed below 15,200 mark, Indian market suffer with major downfall from January 21, 2008

25 June 2008 The sensex touched an intra day low of 13,731 during the early trades, then pulled back and ended up at 14,220 amidst a negative sentiment generated on the Reserve Bank of India hiking CRR by 50 bps. FII outflow continued in this week.

2 July 2008 The sensex hit an intra day low of 12,822.70 on July 2, 2008. This is the lowest that it has ever been in the past year. Six months ago, on January 10, 2008, the market had hit an all time high of 21206.70. This is a bad time for the Indian markets, although Reliance and Infosys continue to lead the way with mostly positive results. Bloomberg lists them as the top two gainers for the Sensex, closely followed by ICICI Bank and ITC Ltd.

6 October 2008 The sensex closed at 11801.70 hitting the lowest in the past 2 years.

10 October 2008 The Sensex today closed at 10527,800.51 points down from the previous day having seen an intraday fall of as large as 1063 points. Thus, this week turned out to be the week with largest percentage fall in the SenseX

18 May 2009 After the result of 15th Indian general election Sensex gained 2100.79 points from the previous close of 12173.42, a record one-day gain. In the opening trade itself the Sensex evinced a 15% gain over the previous close which led to a two-hour suspension in trading. After trading resumed, the Sensex surged again, leading to a full day suspension of trading.

BSE indices

For the premier stock exchange that pioneered the securities transaction business in India, over a century of experience is a proud achievement. A lot has changed since 1875 when 318 persons by paying a then princely amount of Re. 1, became members of what today is called Bombay Stock Exchange Limited (BSE).

Over the decades, the stock market in the country has passed through good and bad periods. The journey in the 20th century has not been an easy one. Till the decade of eighties, there was no measure or scale that could precisely measure the various ups and downs in the Indian stock market. BSE, in 1986, came out with a Stock Index-SENSEX- that subsequently became the barometer of the Indian stock market.

The launch of SENSEX in 1986 was later followed up in January 1989 by introduction of BSE National Index (Base: 1983-84 = 100). It comprised 100 stocks listed at five major stock exchanges in India - Mumbai, Calcutta, Delhi, Ahmedabad and Madras. The BSE National Index was renamed BSE-100 Index from October 14, 1996 and since then, it is being calculated taking into consideration only the prices of stocks listed at BSE. BSE launched the dollar-linked version of BSE-100 index on May 22, 2006.

With a view to provide a better representation of the increasing number of listed companies, larger market capitalization and the new industry sectors, BSE launched on 27th May, 1994 two new index series viz., the 'BSE-200' and the 'DOLLEX-200'. Since then, BSE has come a long way in attuning itself to the varied needs of investors and market participants. In order to fulfill the need for still broader, segment-specific and sector-specific indices, BSE has continuously been increasing the range of its indices. BSE-500 Index and 5 sectoral indices were launched in 1999. In 2001, BSE launched BSE-PSU Index, DOLLEX-30 and the country's first free-float based index - the BSE TECk Index. Over the years, BSE shifted all its indices to the free-float methodology (except BSE-PSU index).

BSE disseminates information on the Price-Earnings Ratio, the Price to Book Value Ratio and the Dividend Yield Percentage on day-to-day basis of all its major indices.

The values of all BSE indices are updated on real time basis during market hours and displayed through the BOLT system, BSE website and news wire agencies.

All BSE Indices are reviewed periodically by the BSE Index Committee. This Committee which comprises eminent independent finance professionals frames the broad policy guidelines for the development and maintenance of all BSE indices. The BSE Index Cell carries out the day-to-day maintenance of all indices and conducts research on development of new indices.[8]

Sensex correlation with emerging market indices

Sensex is significantly correlated with the stock indices of other emerging markets[9][10]

Awards

- The World Council of Corporate Governance has awarded the Golden Peacock Global CSR Award for BSE's initiatives in Corporate Social Responsibility (CSR).

- The Annual Reports and Accounts of BSE for the year ended March 31, 2006 and March 31 2007 have been awarded the ICAI awards for excellence in financial reporting.

- The Human Resource Management at BSE has won the Asia - Pacific HRM awards for its efforts in employer branding through talent management at work, health management at work and excellence in HR through technology

See also

- Clause 49

- National Stock Exchange of India

- Companies listed on the Bombay Stock Exchange

- List of South Asian stock exchanges

References

- ↑ "Bseindia". Bseindia. http://www.bseindia.com/about/introbse.asp. Retrieved 2010-08-26.

- ↑ "BSE - Key statistics". Bseindia.com. http://www.bseindia.com/about/st_key/list_cap_raised.asp. Retrieved 2010-08-26.

- ↑ World Federation of Exchanges (2007) "World Federation of Exchanges (2007)"

- ↑ BSE website, "Listing and Capital Raised"

- ↑ Market Hours, Bombay Stock Exchange via Wikinvest

- ↑ "BSEIndia". BSEIndia. http://www.bseindia.com/about/tech.asp. Retrieved 2010-07-28.

- ↑ "BSEIndia". BSEIndia. 2003-09-01. http://www.bseindia.com/about/abindices/bse30.asp. Retrieved 2010-07-28.

- ↑ "BSEIndia". BSEIndia. http://www.bseindia.com/about/abindices/preface.asp. Retrieved 2010-08-26.

- ↑ "BSE SENSEX Index Chart - Yahoo! Finance". Finance.yahoo.com. http://finance.yahoo.com/echarts?s=%5EBSESN#chart1:symbol=^bsesn;range=my;compare=^gspc+eww+ewy;indicator=volume;charttype=line;crosshair=on;ohlcvalues=0;logscale=on;source=undefined. Retrieved 2010-07-28.

- ↑ http://www.reutersindia.net/ Asia Technical Analysis with Phil Smith

External links

- Bombay Stock Exchange website

- BSE to launch Sensex Futures in US

- The Evolution Of Indian Stock Market

|

|||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||